Empowering Profitability and Digital Disruption through Modern Data Architecture

To drive profitability and digital innovation, our client, a leading financial institution (the Bank), sought to modernize their data infrastructure and enhance their operational efficiency, profitability, and digital disruption capabilities.

A key challenge the Bank faced was the significant complexity in integrating structured and unstructured data to power predictive analytics and improve the effectiveness of their cross- selling strategies. Siloed data sources and legacy systems hindered the Bank’s ability to gain a comprehensive, real-time view of their customers, limiting their agility and competitiveness in the market.

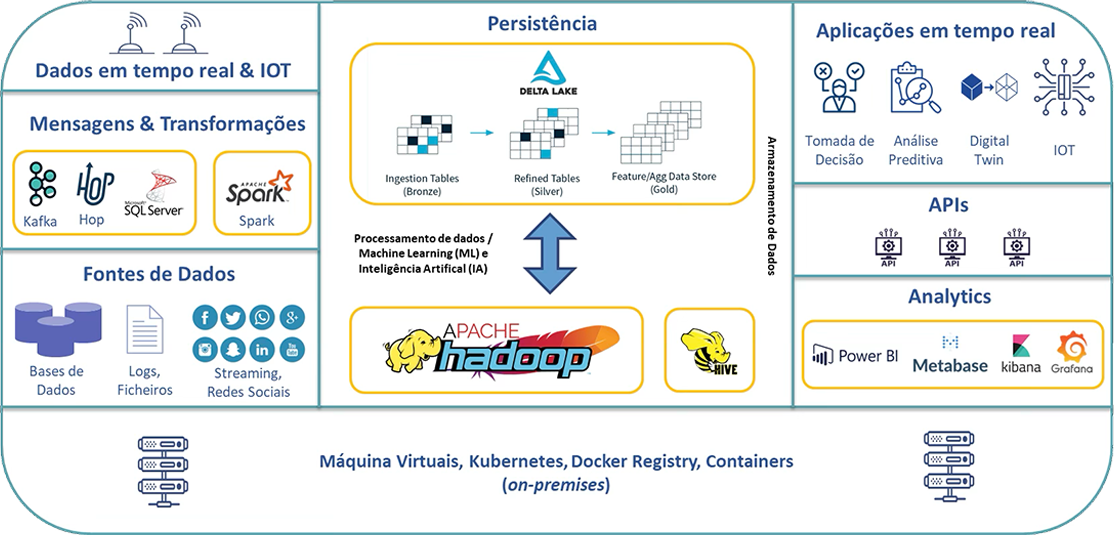

Recognizing the Bank’s need for a future-ready data solution, Mooddie Digital Data Consulting (Mooddie) stepped in to lead the transformation of their data infrastructure. Mooddie implemented a modern, scalable, and 100% open-source Data Lake that empowered the Bank to overcome their data integration challenges and unlock the power of predictive analytics.

Key Capabilities of the Open-Source Data Lake

- The Data Lake’s robust architecture enabled the Bank to centralize and harmonize data from a diverse range of sources, including core banking systems, customer relationship management platforms, and external data feeds.

- By leveraging the Data Lake’s analytics capabilities, the Bank’s data scientists could develop sophisticated predictive models to identify cross-selling opportunities, optimize pricing strategies, and enhance customer segmentation.

- The open-source technology stack allowed the Bank to scale their Data Lake infrastructure as their data volumes and analytical needs grew, without the burden of costly proprietary software licenses.

- The flexible, modular design of the Data Lake enabled the Bank to quickly adapt to evolving business requirements and integrate emerging technologies, preparing them for the digital challenges of the future.

Driving Cross-selling success through data-driven insights with the mooddie-powered Data Lake, the Bank gained a comprehensive, real-time view of their customers, empowering them to identify valuable cross-selling opportunities and deliver personalized product recommendations. The predictive analytics capabilities enabled the Bank to predict customer needs with greater accuracy, leading to a significant increase in cross-sell conversion rates and revenue growth.

The organization operated multiple legacy systems and applications, each with its own set of structured and unstructured data. This fragmentation made it difficult to obtain a comprehensive and unified view of the customers and the bank’s operations. The manual processes and ad-hoc solutions used to integrate these disparate data sources were slow, error-prone, and unable to meet the growing demands for real-time analysis and insights. The lack of a robust data governance framework compromised the reliability, security, and regulatory compliance of the information. The bank struggled to ensure the integrity, traceability, and controlled access to its data assets. This complex data infrastructure directly impacted the bank’s operational efficiency. Consequently, the bank was losing cross-selling opportunities, unable to fully leverage the potential of its data, and falling short of its profitability and digital disruption objectives.

Faced with this challenging scenario, the bank sought the partnership of Mooddie Digital Data Consulting to transform its data infrastructure and drive its digital transformation journey.

To address the bank’s complex data infrastructure challenges, Mooddie Digital Data Consulting implemented a comprehensive and scalable solution, centered around a 100% open-source Data Lake. Mooddie’s Data Lake solution incorporates advanced data integration capabilities, ensuring the harmonization and standardization of the information. Additionally, the solution includes a robust data governance framework, with access controls, traceability, and robust auditing capabilities, aligned with the industry’s regulatory requirements. Leveraging the unified Data Lake architecture, Mooddie enabled the bank to develop sophisticated predictive analytics models. By adopting a 100% open-source approach, Mooddie ensured that the bank’s Data Lake was built on a scalable and cost- effective technology Foundation. This approach eliminated the need for expensive proprietary software licenses, allowing the bank to reallocate those resources to further drive its digital transformation.

Data-Driven Cross-Selling

The client now automatically identifies consumers with a greater potential to acquire new products, resulting in a significant increase in campaign conversion rates.

Improvement in Customer Relationship Management

With a holistic view of each customer, the Bank was able to offer personalized solutions and develop more relevant campaigns, enhancing the customer experience.

Decisions Based on Reliable Indicators

Accurate and real-time updated indicators facilitated quick and informed strategic decision-making.

Agility in Information Retrieval

The implemented architecture ensures rapid accessibility to large volumes of data, enabling swift campaign launches and strengthening the bank’s competitiveness.

The implementation of the Data Lake has created a robust data integration infrastructure that efficiently consolidates multiple information sources in a structured and timely manner. This modern architecture is designed for scalability and flexibility, positioning the Bank for a potential migration to the cloud, which is expected to be the future of data management. With this setup, our client is now equipped to handle large volumes of data, develop customized indicators, and conduct advanced analyses. This capability enables rapid campaign launches, supports informed strategic decision-making, and fosters continuous innovation.